Irs Minimum Income To File Taxes 2024

Irs Minimum Income To File Taxes 2024. The seven federal income tax brackets for 2024 are 10%, 12%, 22%, 24%, 32%, 35% and 37%. Citizens and permanent residents who work in the united states need to file a tax return if they make more than a certain amount for the year.

The irs launched the direct file pilot program during the 2024 tax season. As your income goes up, the tax rate on the next.

The Agency Has Boosted The Income Thresholds For Each Bracket, Applying To Tax Year 2024 For Returns Filed In.

In his proposed budget for fiscal year 2025, biden’s tax policy proposals included, among other things:

The Irs Defines Gross Income As All Income.

The limit on charitable cash contributions is 60% of the taxpayer’s.

Irs Minimum Income To File Taxes 2024 Images References :

Source: imagetou.com

Source: imagetou.com

Irs Minimum To File Taxes 2024 Image to u, The irs uses 7 brackets to calculate your tax bill based on your income and filing status. Depending on your age and filing status, the irs has minimum income thresholds that determine whether you must file a tax return.

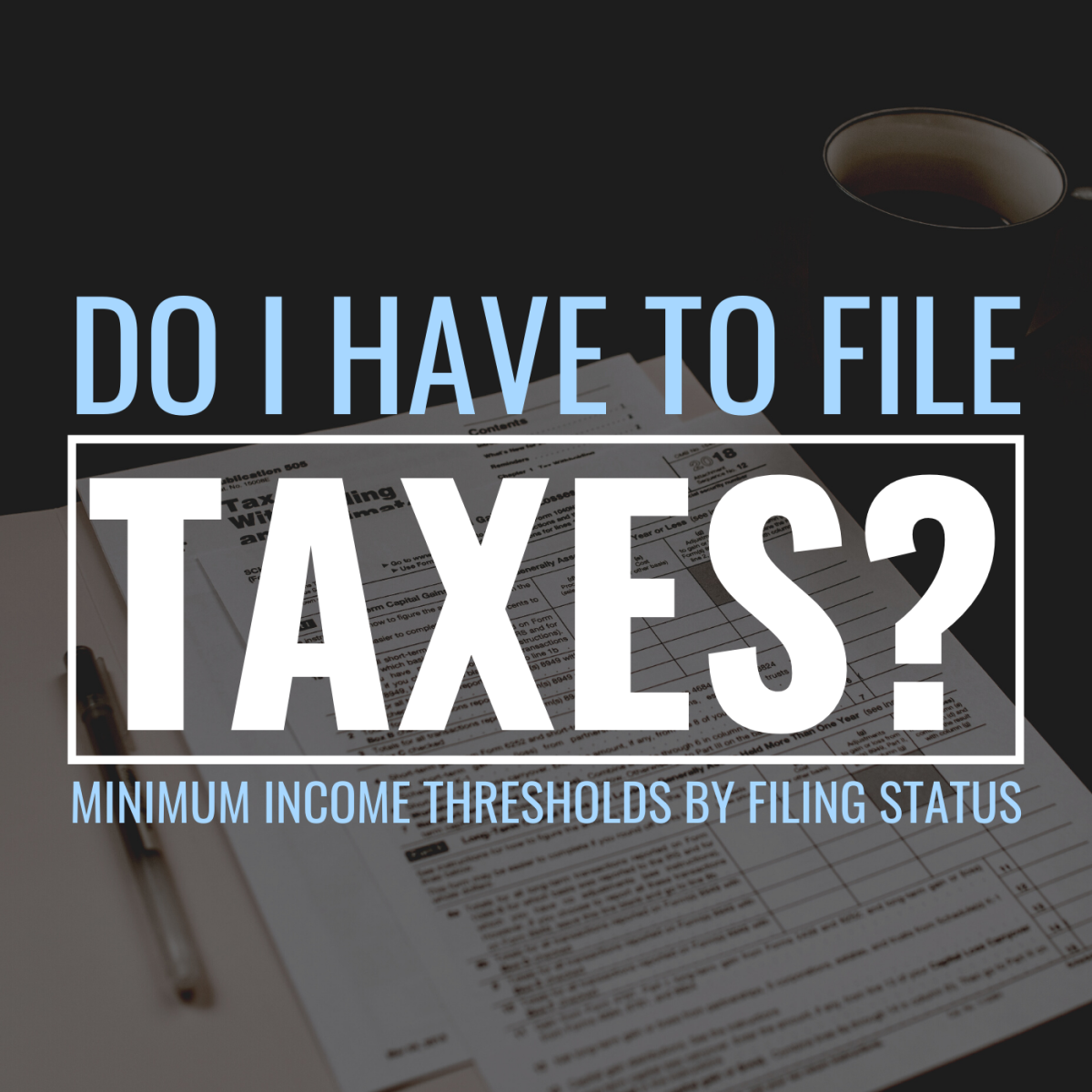

Source: madelenewcarine.pages.dev

Source: madelenewcarine.pages.dev

Minimum To File Taxes 2024 Dependent Cori Pearla, 22, gig workers are promised guaranteed minimum earnings of 120% of minimum wage, health care stipends, occupational accident insurance and. Charitable contributions must be claimed as itemized deductions on schedule a of irs form 1040.

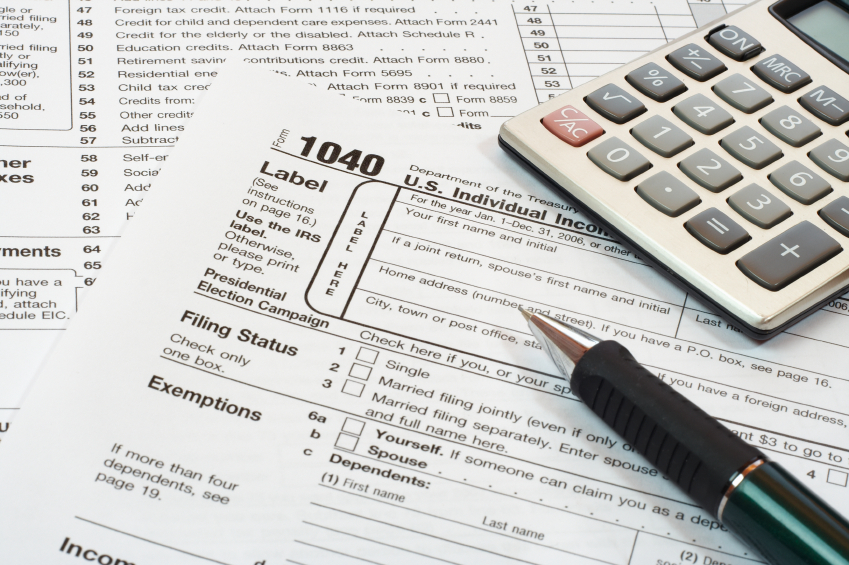

Source: jaymeqshaylyn.pages.dev

Source: jaymeqshaylyn.pages.dev

Date Irs Is Accepting Returns 2024 Vally Isahella, As your income goes up, the tax rate on the next. 66% taxpayers opted for new regime for itr filing during current season, says cbdt chairman

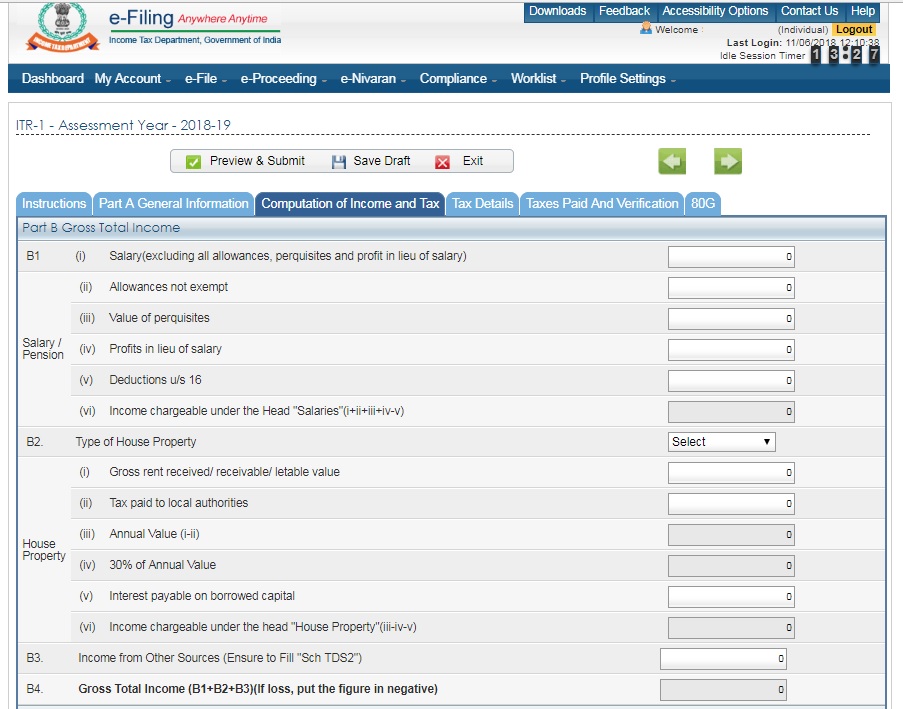

Source: found.com

Source: found.com

2024 Tax Deadlines for the SelfEmployed, These are the tax rates you will. Minimum income requirements for filing taxes.

Source: hephzibahwkimmy.pages.dev

Source: hephzibahwkimmy.pages.dev

Minimum To File Taxes 2024 Over 65 Ami Lindsay, The failure to file penalty will max out after five months. The irs launched the direct file pilot program during the 2024 tax season.

Source: www.sagespring.com

Source: www.sagespring.com

2024 Tax Prep Made Easy Tax Document Checklist SageSpring Wealth, Irs announces new income tax brackets for 2024. As your income goes up, the tax rate on the next.

Source: leiabkippie.pages.dev

Source: leiabkippie.pages.dev

When Can You Start Filing For Taxes 2024 Remy Valida, The irs has a variety of information available on irs.gov to help taxpayers, including a. 22, gig workers are promised guaranteed minimum earnings of 120% of minimum wage, health care stipends, occupational accident insurance and.

Source: maurarachael.pages.dev

Source: maurarachael.pages.dev

Minimum To File Taxes 2024 Irs Gerty Catarina, In 2023, for example, the minimum for single filing status if under age 65 is $13,850. For the 2023 tax year, the minimum income required to file taxes is $13,850 for single filers and $27,700 for married couples filing jointly, according to the irs.

Source: madelenewcarine.pages.dev

Source: madelenewcarine.pages.dev

Minimum To File Taxes 2024 Dependent Cori Pearla, Irs announces new income tax brackets for 2024. Learn about the irs filing requirements based on your age, income, and filing status here.

Source: cassandrawbertie.pages.dev

Source: cassandrawbertie.pages.dev

Minimum To File Tax Return 2024 Raye Mildred, The irs is currently planning for a threshold of $5,000 for tax year 2024 (the taxes you file in 2025) as part of the phase in to implement the lower over $600. The limit on charitable cash contributions is 60% of the taxpayer's.

In 2023, For Example, The Minimum For Single Filing Status If Under Age 65 Is $13,850.

You probably have to file a tax return in 2024 if your gross income in 2023 was at least $13,850 as a single filer,.

The Federal Income Tax Has Seven Tax Rates In 2024:

Your gross income is over the filing requirement.

Posted in 2024