States With No Sales Tax 2024

States With No Sales Tax 2024. 6.75% (on more than $19,800 of. As of january 2024, california holds the highest statewide sales tax rate of 7.25%, followed by four states with tax rates of 7%.

The states that do not have state sales. Maryland has two sales tax holidays in 2024.

Colorado Has A Sales Tax Of 2.9%.

6.75% (on more than $19,800 of.

As There Are No Local Sales Taxes In Maryland, The Exemptions Apply To State Taxes Only.

As of january 2024, california holds the highest statewide sales tax rate of 7.25%, followed by four states with tax rates of 7%.

A Vacation From Sales Tax, If You Will.

Beginning july 1, 2027, the rate reverts back to 4.5%.

Images References :

Source: www.financestrategists.com

Source: www.financestrategists.com

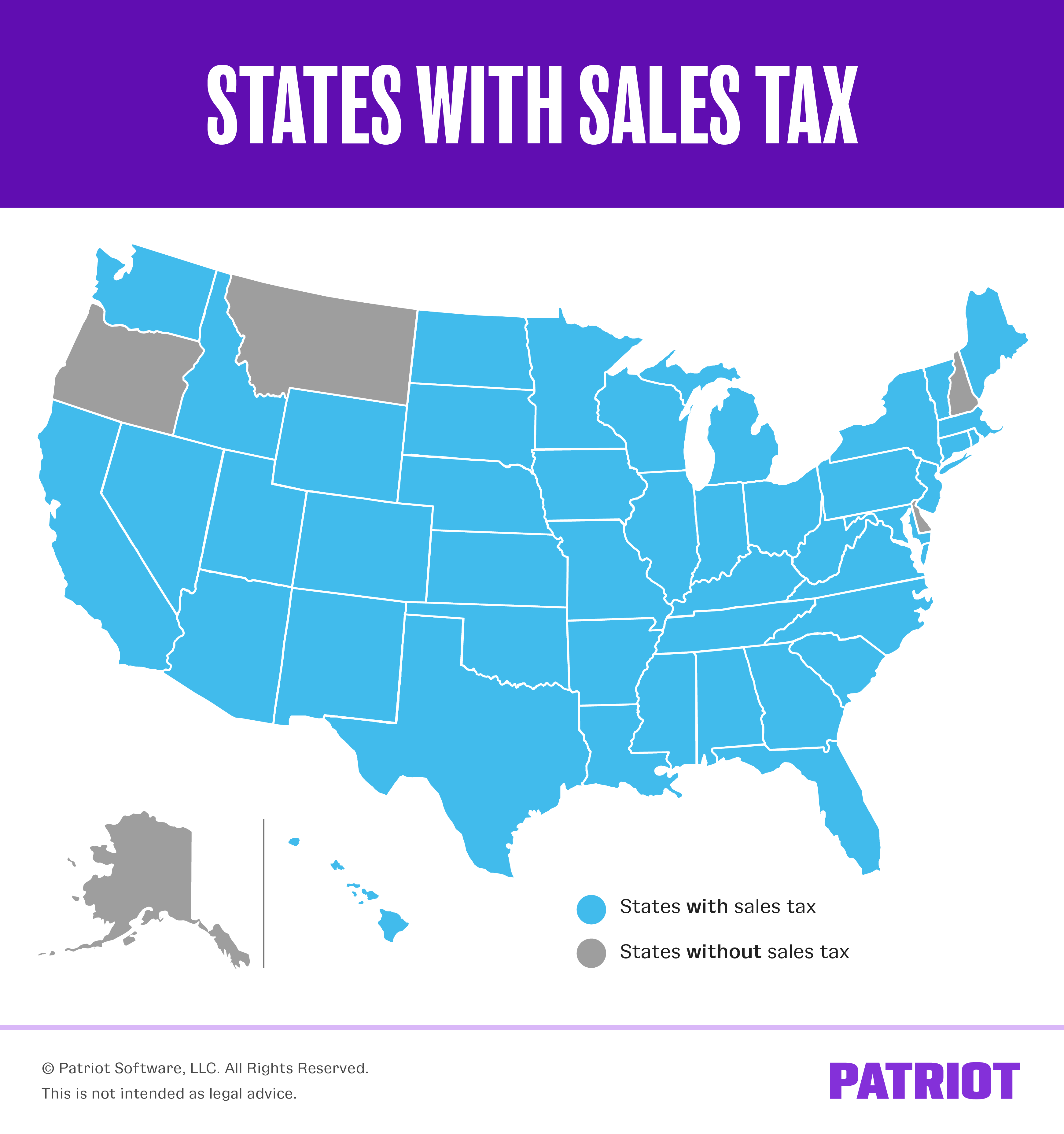

States With No Sales Tax and How They Make Up for It, States with no sales tax. 47 rows there are six states with sales tax under 4%.

Source: www.ramseysolutions.com

Source: www.ramseysolutions.com

Five States Without Sales Tax Ramsey, Before july 1, 2023, the rate is 4.5%. States with no sales tax.

Source: www.patriotsoftware.com

Source: www.patriotsoftware.com

Sales Tax Laws by State Ultimate Guide for Business Owners, The states that do not have state sales. A vacation from sales tax, if you will.

Source: www.accuratetax.com

Source: www.accuratetax.com

What States Have No Sales Tax? The NOMAD states, The state’s property taxes are at an average of $19.26 per $1,000 assessed value in 2021. The other five— oregon, new hampshire, montana, delaware, and alaska — have.

Source: wisevoter.com

Source: wisevoter.com

States With Lowest Taxes 2023 Wisevoter, Buying a new or used car is one of the largest purchases many people will ever make. High income taxes ranging from.

.png) Source: taxfoundation.org

Source: taxfoundation.org

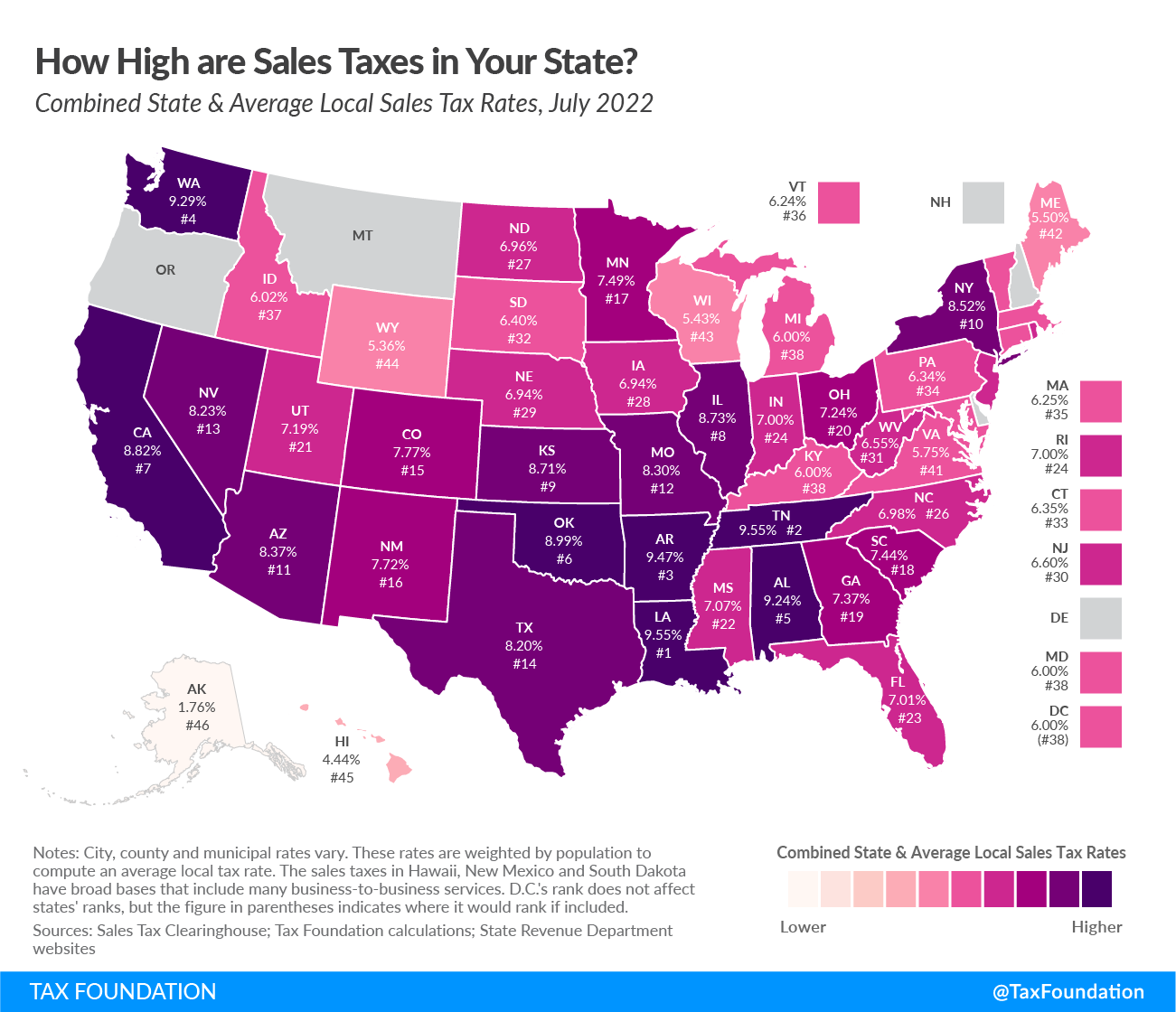

Monday Map Combined State and Local Sales Tax Rates, The tax year 2024 changes will apply to income tax returns filed in 2025. Effective july 1, 2023, remote retailers must collect.

Source: wisevoter.com

Source: wisevoter.com

States Without Sales Tax 2023 Wisevoter, Free online 2024 us sales tax calculator. 1% (on up to $3,100 of taxable income).

Source: www.troutcpa.com

Source: www.troutcpa.com

OutofState Sales Tax Compliance is a New Fact of Life for Small, Maryland has two sales tax holidays in 2024. The state’s property taxes are at an average of $19.26 per $1,000 assessed value in 2021.

Source: taxfoundation.org

Source: taxfoundation.org

State and Local Sales Tax Rates, Midyear 2022, The states with no car sales tax include: The state has a local sales tax rate of.

Source: www.compareremit.com

Source: www.compareremit.com

9 US States That Don't Charge State Taxes, Effective july 1, 2023, remote retailers must collect. 2024 us sales tax by state, updated frequently.

Alaska Is Ranked Among The States With The Lowest Or No Sales Tax.

47 rows there are six states with sales tax under 4%.

The State’s Property Taxes Are At An Average Of $19.26 Per $1,000 Assessed Value In 2021.

This major investment brings both.

Combined Sales Tax Rate (2024):

Rate of combined sales tax in 2024:

Posted in 2024